child tax credit 2022 update

In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. Already claiming Child Tax Credit.

The Child Tax Credit What S Changing In 2022 Northwestern Mutual

Single or married and filing separately.

. The Child Tax Credit is completely refundable. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. Here is everything you need to know about the child tax credit and other.

Man receives a tax refund check from the government. Dozens of House Democrats are calling on caucus leadership to extend the enhanced. Families could be eligible to.

Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec. The 2017 Tax Cuts and Jobs Act TCJA increased the maximum value of the credit to 2000 per child but limited the amount families could receive as a refund to 1400. The Child Tax Credit Update Portal is no longer available.

Making a new claim for Child Tax Credit. Enhanced child tax credit. According to the Associated Press.

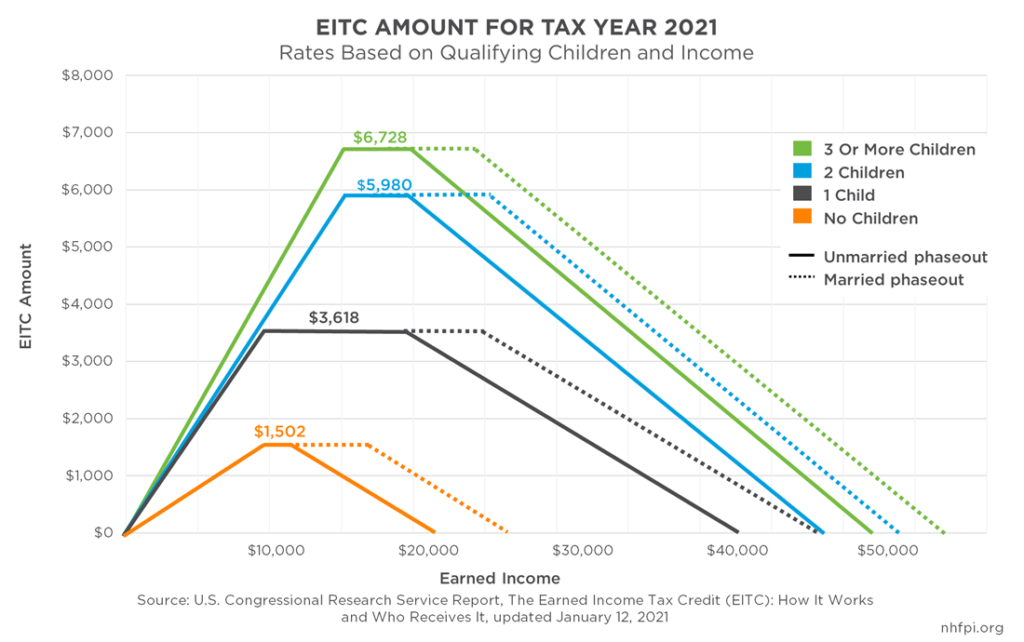

The amount you will receive depends on your income and filing status but the credits. The maximum child tax credit amount will decrease in 2022. 6728 with three or more qualifying children in 2021 to 6935 with three or more qualifying children in 2022.

The calculation of the child tax credit in 2023 will be different than in previous yearsAs inflation increases the credit amount will decrease. CTC Update 2023 is one of the most anticipated announcements by many families in the United States. Jump directly to the.

Up to 3600 per child or up to 1800 per child if you. That program part of the 2021 American Rescue Plan Act let families receive up to 3600 per child under the age of 6 and 3000 for children ages 6 to 17. Child Tax Credit Changes.

WHILE 2021 monthly child tax credit payments have ended a new program could provide families with 4000 per childThe funds are part of a lesser-kno. So even if you dont owe any taxes you may earn the credit if you file your annual tax returns. 2 days agoAccording to Welsh the maximum credit shifts are.

Colorado is rolling out a new child tax credit in 2022 that is similar to the federal support. How much money you could be getting from child tax credit and stimulus payments. The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child.

Senators hold out hope on survival of child tax credit. In 2021 parents and. Capitol is seen from the East Front Plaza at sunset on Monday June 7 2021.

The expanded tax credit was originally offered through President Joe Biden s 19 trillion COVID-19 relief package making them available for the first time to millions of children. As of now the child tax credit is worth 2000 per. Page Last Reviewed or.

Long before the expanded. The amount you can get depends on how many children youve got and whether youre. 9 million families are entitled to up to 10000 in checks from the IRS they never claimed.

To apply applicants should visit. The Child Tax Credit in the American Rescue. The one due in April of 2022 then you should go to the IRS website to opt out of receiving monthly payments using the Child Tax Credit Update.

Congressional Democrats Retake Generic Ballot Lead Among Child Tax Credit Recipients Morning Consult

Advanced Child Tax Credit Charlotte Center For Legal Advocacy

Most Common Uses Of 2021 Child Tax Credit Payments Food Utilities Housing Clothes Kids Count Data Center

Child Tax Credit Update Families Will Get Paid 7 200 Per Child In 2022 By Irs Fingerlakes1 Com

Child Tax Credit Here S What To Know For 2022 Bankrate

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Child Tax Credit 2022 Families Can Claim Direct Payments Worth Up To 3 600 Due To Irs Mistake See If You Qualify The Us Sun

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

The Advance Child Tax Credit 2022 And Beyond

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

About The 2021 Expanded Child Tax Credit Payment Program

Expansions Of The Earned Income Tax Credit And Child Tax Credit In New Hampshire New Hampshire Fiscal Policy Institute

The Child Tax Credit S Extra Benefits Are Ending Just As More Parents Are Scrambling For Child Care The New York Times

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

Stimulus Update There May Still Be Hope For Monthly Child Tax Credit Payments In 2022 Here S Why

Expanded Child Tax Credit Available Only Through The End Of 2022 Cbs Los Angeles

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Clearing Up Confusion Surrounding Changes To Child Tax Credit