tax benefit rule examples

For example lets assume that in 2009 Company XYZ expected to receive 100000 from a customer. A tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included in the gross.

For example - you deducted 1000 in state income taxes on your 2012 Schedule A.

. A rule that if one receives a tax benefit from an item in a prior year because of a deduction such as for an uninsured casualty loss or a bad debt write-off and then recovers the money in a. A taxpayer itemized in 2011 and deducted state income taxes paid in 2011. Legal Definition of tax benefit rule.

Tax benefit rule examples - LetspracticeExample2TaxbenefitruleLouprepaysallofhishaircutsforthenext2. A couple paid 4000 in state taxes in the prior year and claimed itemized deductions totaling 14000. The customer never paid so Company XYZ.

Examples of tax benefit. Two examples of the rules early application are Dobson v. Consider a taxpayer who pays 10000 of state income taxes in year 1.

The following examples provide an illustration of the mechanics of the tax benefit rule and how it should work with respect to the new law and the 10000 annual limitation. If the couple received a state tax refund of 500 in the current year the. Jones recovers a 1000 loss that he had written off in his previous years tax.

According to the tax benefit. If a taxpayer for example claimed as a business expense bad debts are written off amounting to 3000 in 2019 and in 2020 managed to recover 2000 of the amount written. The term tax benefit refers to any tax law that helps you reduce your tax liability.

Example of the Tax Benefit Rule. Tax Benefit Rule Examples from PowerPoint Presentation 1. The rule is promulgated by the Internal Revenue Service.

Tax Benefit Rule 55 TAXES 321 1977. The benefits received rule works by taxing individuals or businesses based on how much they use a public service or good. Then your 401 k.

Example of the Tax Benefit Rule. Examples of tax benefit. This represents the total amount of state income tax withheld from your wages in 2012 from.

A few years ago the Treasury Department issued new regulations under section 501c3 with more hypotheticals illustrating key distinctions between the Private Benefit Rule. The tax benefit rule ensures that if a taxpayer takes a deduction attributable to a specific event and the amount is recovered in a subsequent year. For example with a traditional 401 k the tax benefit is that you can reduce your taxable income based on the contributions to your retirement account.

An Essay on the Conceptual Foundations of the Tax Benefit Rule Patricia D. A theory of income tax fairness that says people should pay taxes based on the benefits they receive from the. For example paying a toll accounts for how much.

However in 2012 the taxpayer receives a state tax refund. How Does a Tax Benefit Work.

Chapter 2 Income Tax Concepts C 2008 South Western Kevin Murphy Mark Higgins Kevin Murphy Mark Higgins Ppt Download

What Are Marriage Penalties And Bonuses Tax Policy Center

3 New Tax Rules Could Save You Thousands Dat Freight Analytics Blog

Tips To Use Tax Benefits That Are Available On Home Businesstoday Issue Date Jan 01 2015

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

Investment Expenses What S Tax Deductible Charles Schwab

Publication 970 2021 Tax Benefits For Education Internal Revenue Service

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

Understanding The Kiddie Tax Charles Schwab

Publication 970 2021 Tax Benefits For Education Internal Revenue Service

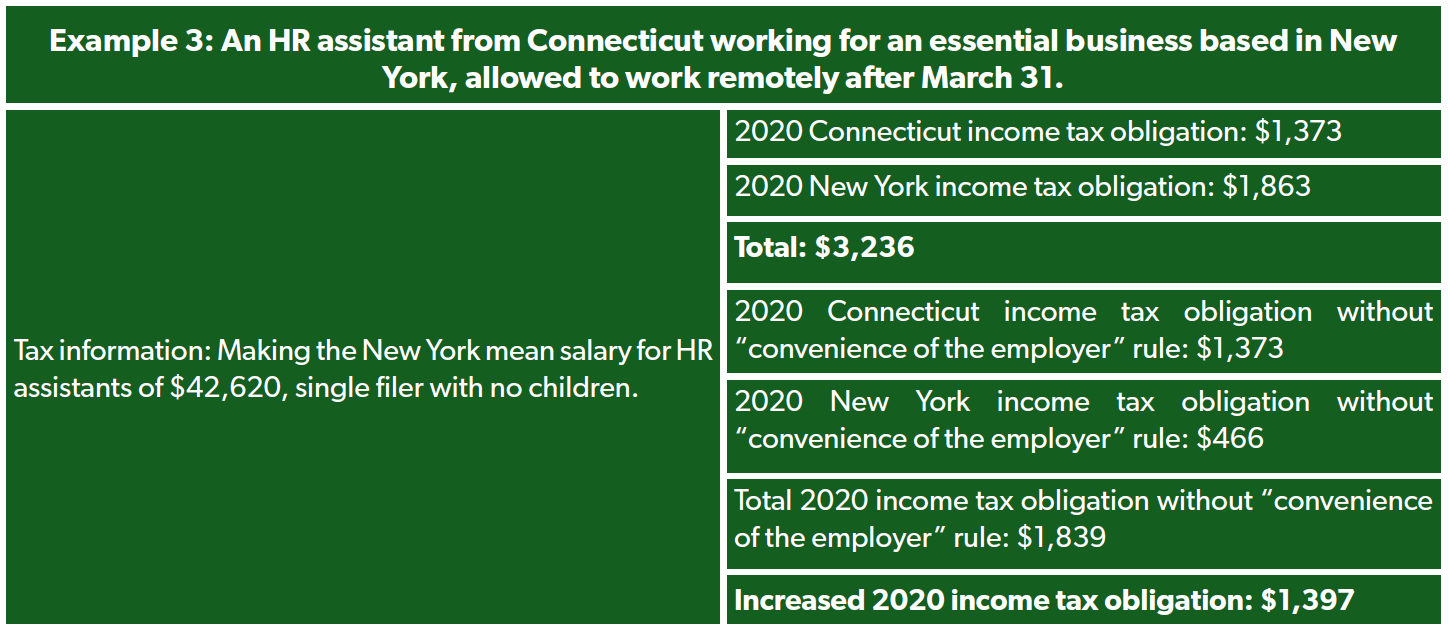

New York S Aggressive Pandemic Tax Strategy Underscores Need For Congressional Action Foundation National Taxpayers Union

Simplifying The Accounting For Income Taxes Under Asc 740 Gaap Dynamics

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

What Is The Tax Benefit Rule Thestreet

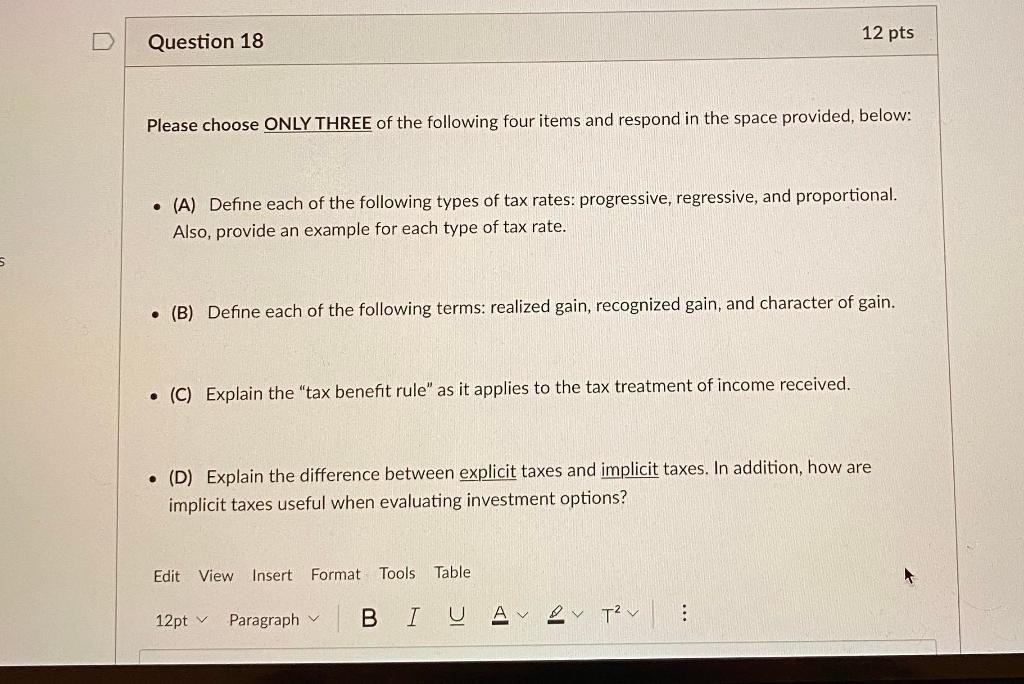

Solved 12 Pts U Question 18 Please Choose Only Three Of The Chegg Com

Form 2 Worksheet Ix Fillable Tax Benefit Rule For Recoveries Of Itemized Deductions

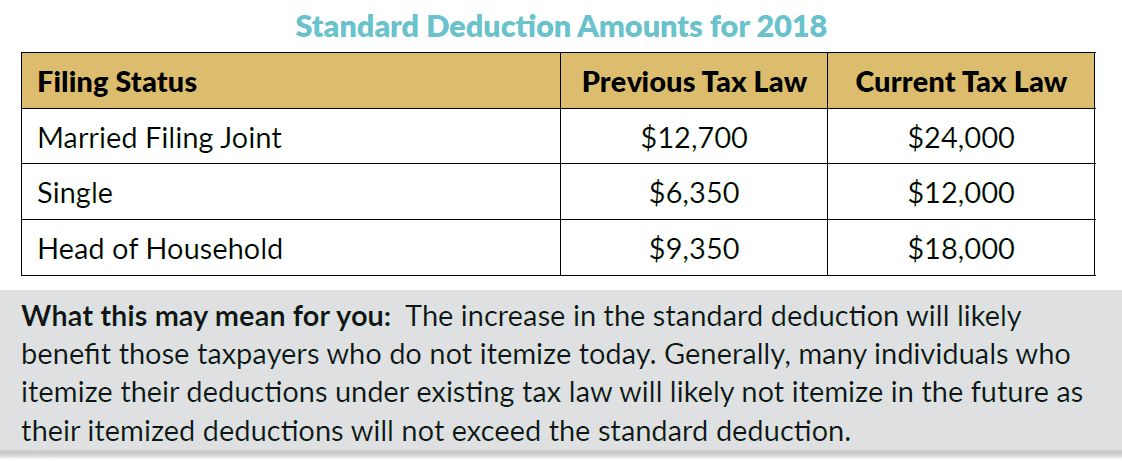

What Is The Standard Deduction Tax Policy Center

Simplifying The Accounting For Income Taxes Under Asc 740 Gaap Dynamics

:max_bytes(150000):strip_icc()/deferredincometax-v3-b8dc55e780ab4f47a0987161ece97060.png)